Abra Sua Conta de Negociação hoje mesmo e conheças as vantagens da RoboForex LP

Analysis for June 29th, 2012

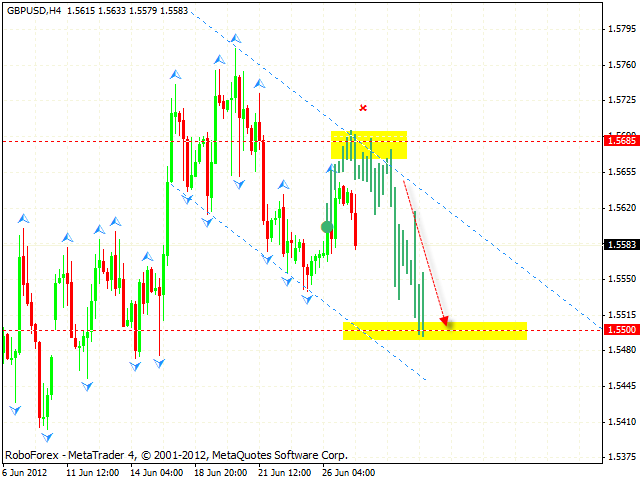

GBP/USD

GBPUSD, Time Frame H4 – Tenkan-Sen and Kijun-Sen intersected below Kumo Cloud (1), both lines are horizontal. Kumo Cloud is going down (2), Senkou Spans A and B are also horizontal. Chinkou Lagging Span is on the chart, the price is on Tenkan-Sen and Kijun-Sen. In the near term, we can expect resistance of Senkou Span B and the price to continue moving falling down.

GBPUSD, Time Frame Н1 – Tenkan-Sen and Kijun-Sen intersected below Kumo Cloud forming “Golden Cross” (1), Tenkan-Sen is directed upwards, and Kijun-Sen is horizontal. Kumo Cloud is going up (2), Senkou Span A turned upwards, and Senkou Span B is also horizontal. Chinkou Lagging Span is above the chart, the price is inside Kumo Cloud. In the near term, we can expect Support of Senkou Span A, resistance of Tenkan-Sen and the price to move downwards. Stop Loss is placed above Tenkan-Sen.

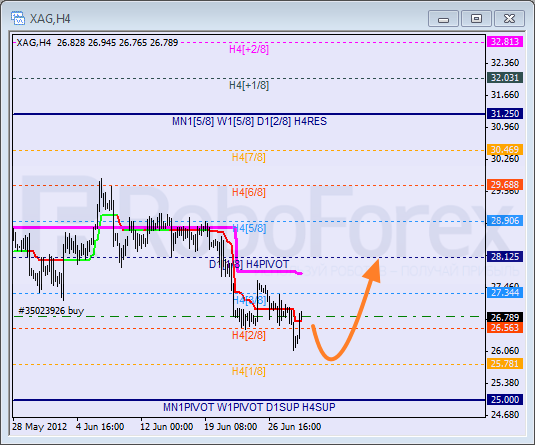

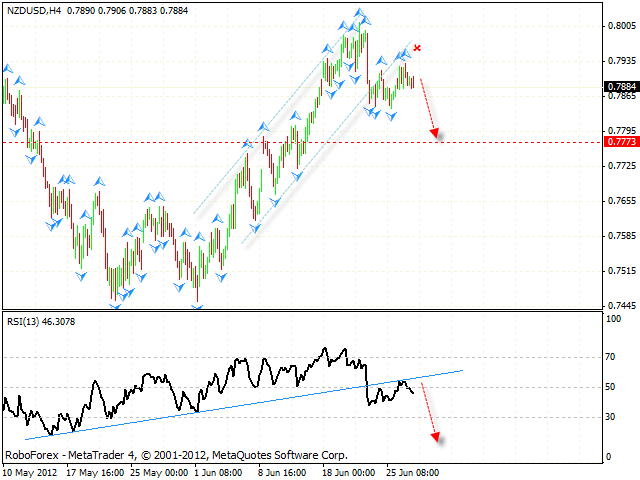

GOLD

XAUUSD, Time Frame H4 – Tenkan-Sen and Kijun-Sen are under pressure of “Dead Cross” (1), Tenkan‑Sen is directed downwards, and Kijun-Sen is horizontal. Ichimoku Cloud is going down (2), Senkou Spans A and B are moving downwards. Chinkou Lagging Span is on the chart, the price is on Kijun-Sen, below Kumo Cloud. In the near term, we can expect resistance of Kijun-Sen and the price to move downwards.

XAUUSD, Time Frame Н1 – Tenkan-Sen and Kijun-Sen intersected below Kumo Cloud forming “Golden Cross” (1), Tenkan‑Sen is directed upwards, and Kijun-Sen is horizontal. Ichimoku Cloud is going down (2), Senkou Span A is moving upwards, and Senkou Span B is horizontal. Chinkou Lagging Span is on the chart, the price is below Kumo Cloud. In the near term, we can expect resistance of Senkou Spans A and B, and the price to fall down.

RoboForex, Nova Zelândia

Endereço: Level 10, 21 Queen Street, Auckland, 1010, New Zealand

Tel:

E-mail: info@roboforex.com

E-mail affiliate: sales@roboforex.com