Murray Math Lines 16.03.2012 (GBP/JPY, USD/CAD, EUR/JPY)

19.03.2012 / 09:16

Analysis for March 19th, 2012

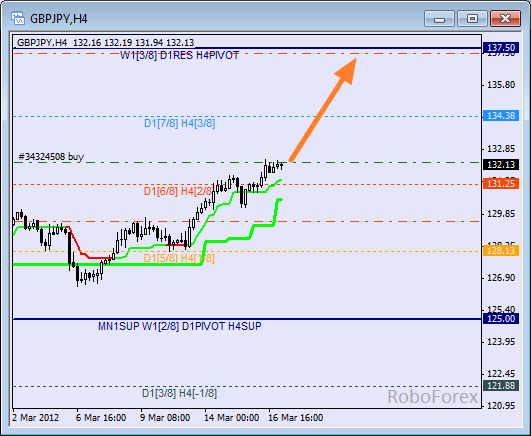

GBP/JPY

The GBP/JPY currency pair was able to fix itself above the 2/8 level, thus indicating that the price may continue growing up towards the 4/8 one. We can expect the pair to move upwards for, at least, about 500 pips more. That’s why I’ve opened a buy order with the target at this level and the stop placed a bit below local minimum.

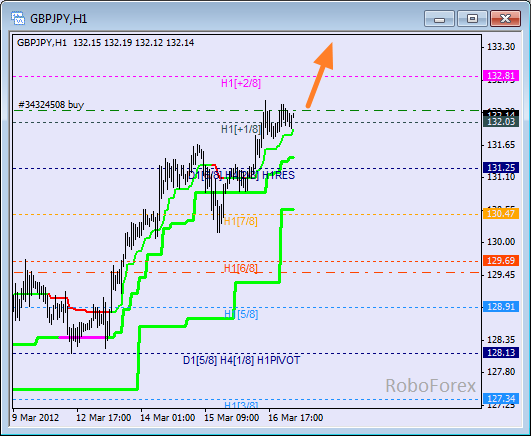

At the H1 chart the price is inside an “overbought zone”, the ascending movement is supported by the H4 Super Trend’s line. It looks like the bulls will be able to break the +2/8 level within the next several days, and the lines at the chart will be redrawn.

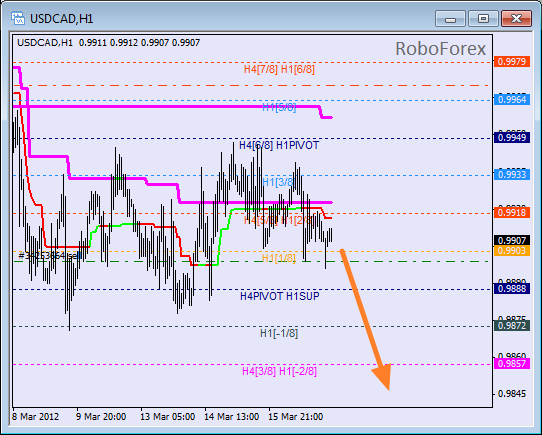

USD/CAD

Canadian Dollar continues consolidating below the daily Super Trend’s line. Taking into consideration the fact that earlier the price rebounded from the 8/8 level, we can expect it to continue moving downwards. The target level for the bears is the 0/8 one.At the H1 chart we can see that the bulls weren’t able to break the 4/8 level during the correction. Most likely, the market will start falling down again, and if it does, the price will break the -2/8 level and the lines at the chart will be redrawn.

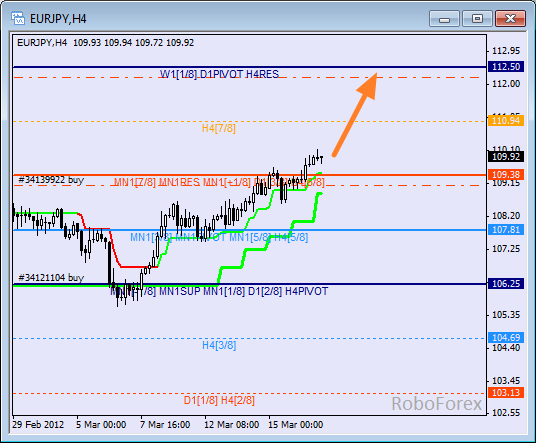

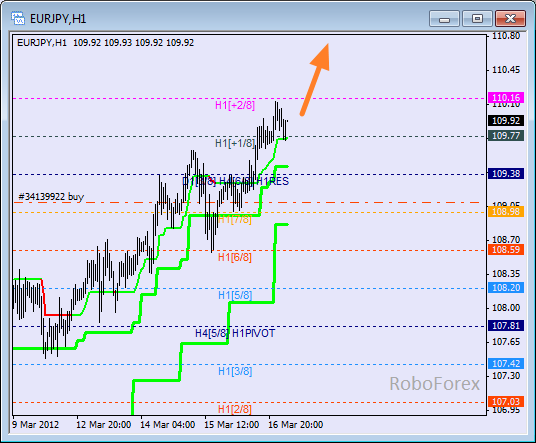

EUR/JPY

The EUR/JPY currency pair did manage to stay above the 6/8 level, thus indicating that the price may continue moving upwards. The target for the bulls is still the 8/8 level. In order to minimize the risk, I’ve decided to move the stop on the second buy order into the black.

At the H1 chart the pair in inside an “overbought zone”, and currently moving above the +1/8 level. Most likely, the market will break the +2/8 level in the nearest future, and the lines at the chart will be redrawn.

Sem comentários:

Enviar um comentário