Murray Math Lines 26.03.2012 (USD/CAD, EUR/JPY, NZD/JPY)

26.03.2012 / 10:52

Analysis for March 26th, 2012

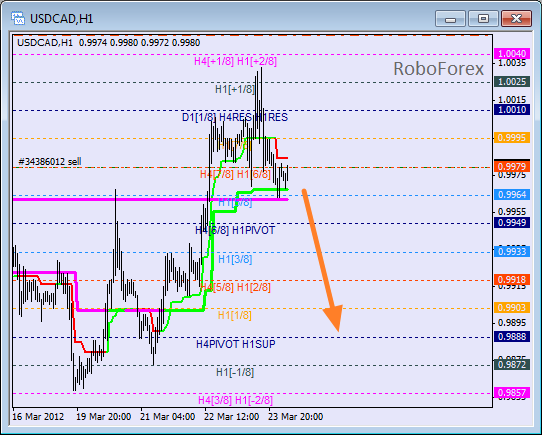

USD/CAD

Canadian Dollar rebounded from the 8/8 level three times in a row, which is a strong bearish signal. If the price breaks the daily Super Trend’s line backwards, the sellers will gain a strong advantage. The short-term target is the 0/8 level.

At the H1 chart the price has left an “overbought zone”, but hasn’t been able to break the Super Trends yet. When it does, the market will fall down towards the 0/8 level. If this level is also broken, the price will move lower.

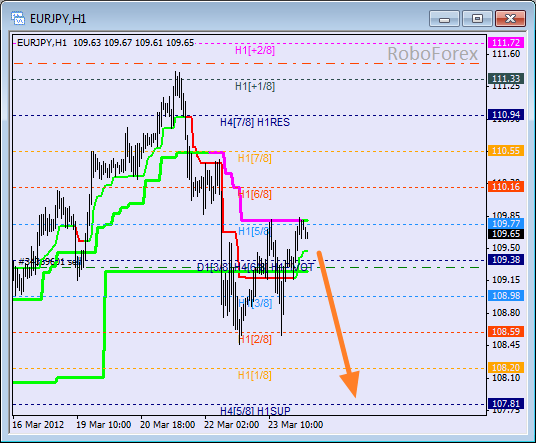

EUR/JPY

After rebounding from the 7/8 level and making a rapid descending movement, the market started the correction, and this movement is supported by the H4 Super Trend’s line. If the price rebounds from this indicator, the market will continue falling down towards the 4/8 level.

At the H1 chart the price is consolidating between the 5/8 and 3/8 levels. Most likely, the price will rebound from the 5/8 level. There is a possibility that the price may reach the 0/8 level within the next several days.

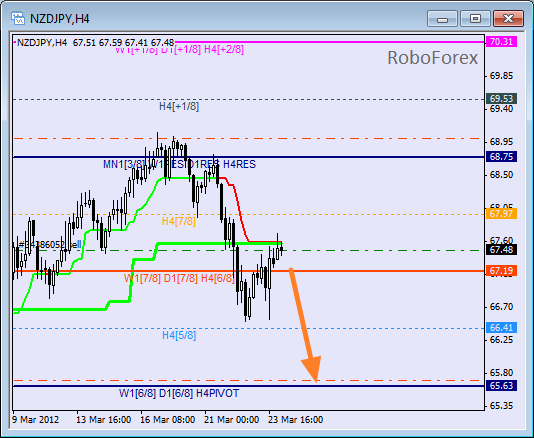

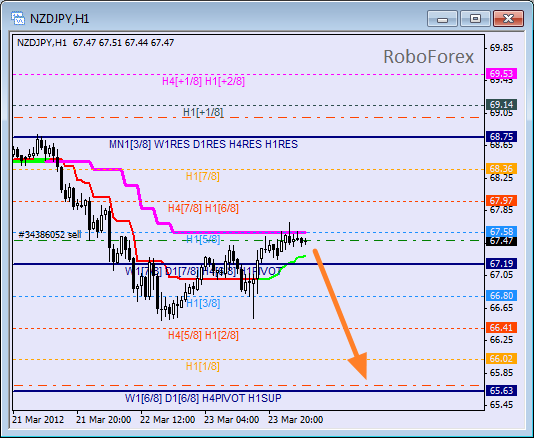

NZD/JPY

After making a rapid descending movement, the NZD/JPY currency pair is being corrected, which is quite logical. The bears are supported by the Super Trends’ lines. If the price rebounds from these indicators, the market will start falling down again towards the 4/8 level.

At the H1 chart the correction faced the resistance from the Super Trend’s line and the 4/8 level. If the pair rebounds from the current levels, the price will continue moving downwards. The short-term target for the bears is at the 0/8 level.

Sem comentários:

Enviar um comentário